Sun Topics

Sun Archives

- Whether to walk away: Housing's moral minefield (3-22-2009)

- Builder: It is 'rational' for homeowners to walk away (3-13-2009)

Sun Coverage

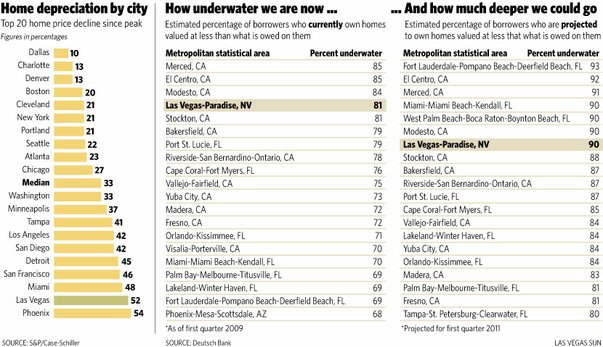

Las Vegas homeowners are more likely than those elsewhere to walk away from their mortgages even though they can afford them, according to a study by two Chicago-area universities. The reason: Las Vegas — where 81 percent of homes are worth less than their mortgages based on the latest figures — leads the nation in the rate of foreclosures. And the decision to default on a mortgage can be contagious. The more it occurs, the more acceptable it becomes.

Researchers at the University of Chicago Booth School of Business and Northwestern University found that the willingness to default increases with the proportion of foreclosures in a ZIP code. People who know someone who defaulted are 82 percent more likely to declare their intention to do so, the study concluded.

The ramifications for Las Vegas: The growing number of foreclosures can have a snowball effect. Homeowners saddled with homes worth only half their initial value are watching friends and neighbors default — lessening the moral constraints and social stigma that usually come with foreclosures, the researchers said.

They concluded that 26 percent of all mortgage defaults nationally were the result of deliberate, strategic decisions by homeowners who could afford to pay the mortgage, but chose not to.

In a national survey of 2,000 homeowners, most respondents said they thought it was morally wrong to default as a deliberate strategy.

But the more the amount of the mortgage eclipsed the current value of the house, the greater the percentage of homeowners who said they would walk away. Seventeen percent said they would default if their mortgage exceeded the value of their home by 50 percent — even if they could afford to pay.

When asked at what point they would default, 7 percent of homeowners said they would walk if their mortgage were $50,000 more than the value of their house, compared with 38 percent who said they would default if their mortgage exceeded the house value by $300,000.

The younger the homeowner, the more willing he was to default, the study found.

The median price of homes sold in Las Vegas has fallen more than 50 percent since June 2006, and Deutsche Bank reported Thursday that 81 percent of Las Vegas homes were underwater at the end of this year’s first quarter. It projected that 90 percent of homes would be underwater by 2011.

Hardest hit in Las Vegas are buyers who purchased homes from 2005 to 2008.

The first wave of foreclosures was triggered by subprime loans resetting monthly payments beyond what people could afford, and job losses and frustration among underwater homeowners will contribute to the next wave.

“I think Las Vegas is one of the worst markets from the point that a lot of people are underwater,” said Luigi Zingales, a professor at the University of Chicago who conducted the study with two other professors. “If the forecast is correct, the situation is not good.”

What will determine the number of Las Vegans who will walk away is how they see the future, Zingales said. If they see the market rebounding, they will stay in their homes for now.

“But it they don’t see things improving, they will lose hope, and there can be massive (additional) defaults,” he said.

Zingales said one solution would be for lenders to forgive principle in exchange for getting some of the appreciation when home prices rebound. The Obama administration recently made it easier for those with negative equity to refinance Fannie Mae and Freddie Mac mortgages. The new rule allows up to 25 percent negative equity, up from 5 percent.

“If people look at walking away for purely an economic decision, we are going to have a lot more people walking away from their homes,” said Jeremy Aguero, principal of the research firm Applied Analysis. “It would create a huge wave of problems and ramifications for the banks if a mass of people walked away from their mortgage obligations all together. It would be huge and a disaster.”

The social stigma of default lessens if others are doing it, Zingales and others said, and the more people who walk away from their homes, the more contagious the strategy becomes.

Some homeowners may stop paying on their mortgages and, while still living in the houses, apply that money toward credit card debt or other needs, said Richard Plaster, founder of Signature Homes.

Shari Olefson, author of “Foreclosure Nation: Mortgaging the American Dream,” said she thinks the number of people who walk away will be limited because she doesn’t expect prices to fall much further.

Besides, families can be reluctant to have to find a new home and put their children in new schools, or are unwilling to take a hit on their credit, affecting their ability to get loans and saddling themselves with higher interest payments.

Olefson said she is concerned, however, that over time some owners will become fatigued with their home values and get more comfortable with the thought of walking away. Many are waiting to get loan modifications, but if that doesn’t happen, they are vulnerable.

Olefson said the decision to walk away is a conversation people should have with their pastors rather than their financial advisers. She said she considers it wrong to walk away even though she understands people’s anger at declining home values caused in part by neighbors’ foreclosures. It’s easy to make excuses because Wall Street contributed to the problem, she said.

“I think they should investigate every alternative before they seriously think about walking away from their obligation,” Olefson said. “It is un-American to walk away from obligations. Can you imagine if we all did that?”

A version of this story appeared in In Business Las Vegas, a sister publication of the Sun.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy