Reader poll

Related Document (.pdf)

Sun Archives

As other parts of the country win tens of millions of dollars in court judgments against online tourism companies, Clark County commissioners are talking about following suit.

At issue is the amount of hotel room taxes paid by online travel sites. They obtain blocks of rooms at wholesale prices from hotels and pay lower room taxes on those lower prices — but they are selling those rooms at higher prices.

Some municipalities and states have successfully argued that they should be collecting more taxes for the rooms sold at the higher prices. Travel Weekly, a trade magazine, reported that as of May, 46 cities and counties had filed lawsuits alleging just that. The number keeps growing. The latest case was filed Monday, when Florida sued Expedia Inc., Orbitz LLC and Orbitz Inc.

Some preliminary rounds have gone against the travel sites.

• In February an administrative judge said online travel booking sites owed Anaheim, Calif., $17.7 million — $8.2 million in taxes and $9.5 million in penalties.

• In July, Expedia Inc. and Hotwire Inc. paid $35 million in hotel room taxes to San Francisco. A California appeals court ruled the payment had to be made before the companies could pursue further legal remedies.

• A week ago in Texas a jury found 11 online companies underpaid hotel occupancy taxes. A federal court judge is to determine how much those companies should pay San Antonio and 172 other Texas cities.

The travel sites have won a few of the battles too, though. A federal appellate court, for example, in January dismissed a suit by Pitt County, N.C., against hotels.com, priceline.com, Expedia, Orbitz and Travelocity, saying that online travel companies are not retailers and do not control room inventories so they are not subject to room, or occupancy, taxes. Similar rulings were made in cases involving Findlay, Ohio; Orange, Texas; and Louisville, Ky.

But with so much money at stake at a time when their coffers are emptying, Clark County commissioners, prodded by lawyers, are now considering joining the march into court. In a letter to Clark County three years ago, local attorneys estimated that for 2000 through 2005, the “lost tax revenue” ranged from $677 million to $723 million.

Commissioner Chris Giunchigliani, who wants commissioners to discuss it at their Nov. 17 meeting, said one of the biggest selling points for her is the potential infusion of money for the School District. But she also figures there is potential upside for casinos: Forcing online sites to pay the full amount would level the playing field for the casinos’ own Web sites that pay the full amount.

“I don’t see it being a negative for them,” she said.

MGM Mirage and many other casino companies do, however. They consider online travel agencies part of their team, not competitors.

The online agencies “play a large role in the marketing of Las Vegas and have been especially important in these economic times,” MGM Mirage spokesman Alan Feldman said this week. “They provide the flexibility to sell large quantities of available rooms through these channels, without which our occupancy and average daily rates would clearly suffer.”

Going after them for the additional room tax revenue “would have extremely negative consequences for our community and a positive outcome only for the lawyers pushing the issue,” Feldman said.

Feldman also noted that the Nevada Tax Commission nixed the idea in 2005.

A four-page legal opinion, which the Tax Commission said was vetted by the state attorney general’s office, says hotel operators are responsible for collecting the room taxes. An online “intermediary” company “neither operates a hotel nor licenses hotel accommodations, and therefore has no statutory obligation to collect” the tax, the opinion notes.

“This is something there is no ambiguity on,” Brent Thompson, an attorney for Expedia, said.

Will Kemp, a Las Vegas attorney vying to sue the online companies on behalf of the county, counters that the legal opinion is just that: an opinion, not a ruling by a judge. “It’s a one-sided presentation” that was produced at the request of a Texas law firm whose clients included an online tourism company, Kemp added.

Lawsuits across the country have made headway against online companies in states with laws that “pretty much say the same thing” as Nevada’s, Kemp said.

He posited this scenario: What if a Las Vegas casino set up a Caribbean online tourism site that purchased rooms wholesale from their own casino and sold them at higher rates without paying the room tax for the retail price of the room?

“Are they saying that would be OK, too?” he said.

Legal argument aside, what’s going to matter more than anything in trying to push a lawsuit forward in Clark County is the question of jobs, several commissioners said.

Will going after an online site lead to fewer businesses, hurt the bottom lines of casinos and cause more layoffs?

“My concern is, if we did sue even on a contingency basis, industry folks in the past have said that we’re unique and our economy relies so much on the ability to fill rooms that if we monkey with the current system, it might cost jobs,” Commission Chairman Rory Reid, a Democratic candidate for governor, said. “There’s nothing I’m more sensitive to than employment right now.”

He added that he’s “not a believer that it’s a slam-dunk lawsuit we could win.”

But if lawyers are willing to take the case on a contingency case, meaning the county wouldn’t have to pay them unless they win a judgment or settlement, maybe it’s worth a try, Commissioner Steve Sisolak said.

Giunchigliani said she’d like a definitive answer on whether “taxes that should be paid on Internet bookings are not being paid.”

The issue was raised several years ago too but it failed to gain traction with county commissioners and a majority of the Las Vegas Convention and Visitors Authority, even though the LVCVA and the county stood to gain the most.

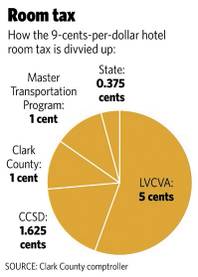

The LVCVA gets 5 cents for every dollar paid for hotel rooms, the county gets 1 cent for its general fund and another penny for a fund that pays for road construction. The Clark County School District gets a little under 2 cents for every dollar paid for hotel rooms and the state gets a little under a half-cent.

As a member of the LVCVA board six years ago, Robert Forbuss, a business and government affairs consultant, was “on a tirade” about online operations not paying additional room taxes.

“It has always rubbed me wrong that these organizations could drain our tax revenues,” Forbuss said.

Back then the economy was booming. But Commissioner Tom Collins, who sat on the LVCVA board then, recalls that the board was swayed by the argument that “ ‘Hey, if we do this, the online agencies will just push other destinations instead of Vegas.’ I mean, if Orlando and Denver and Vegas all have rooms at $100 and this Internet company can sell them for $80 and pay lower taxes in other states, then why would they sell here?”

Because people still want to come to Las Vegas, answered travel researcher Henry Harteveldt, vice president and principal analyst for Forrester Research.

“Las Vegas is a very, very distinct market when it comes to tourism and hospitality,” he said. “I assure you that the (online travel agencies), their owners and investors will be pushing these guys to continue to market themselves and Las Vegas because that’s where people want to go ... If people want to go to Las Vegas, I assure you Expedia Inc., Travelocity, Orbitz and priceline.com will all find ways to promote Las Vegas to their customers.”

These days, however, with the economy in such bad shape and gambling and tourism revenue so far down, even Forbuss isn’t certain that going after the online travel sites is such a good idea.

“Vegas is in such a predicament right now. Everybody is nervous. Will CityCenter overload us? We clearly need to understand how this would impact the market before anyone does anything.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy